US Mint Reevaluates Silver Coin Prices

March 7, 2011 by Darrin Lee Unser · Leave a Comment

Investors and coin collectors are not the only ones taking a new look at silver coins with the price of silver at levels not seen in over thirty years. The US Mint is reevaluating the prices for its silver products.

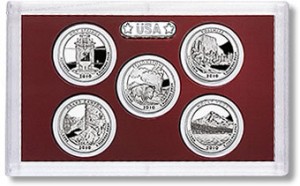

The US Mint is reevaluating the prices for its silver products, including the America the Beautiful Quarters Silver Proof Set which has been taken off sale.

In fact, the US Mint has halted sales of one of its silver related products, namely the 2010 America the Beautiful Quarters Silver Proof Set. As of last week, the set could no longer be ordered. A short notice was placed on the Mint’s online store stating: "This product is temporarily unavailable."

The proof set was issued on May 27, 2010, and had been selling at $32.95 ever since. However, with the price of the white metal skyrocketing in recent weeks, the cushion between the cost of the silver contained within it and the market value of that metal quickly vanished. As shown on this site’s US Mint silver coins and values section, each set contains 0.904 ounces of the precious metal. When the Mint pulled the set, it was selling for about one dollar more than its melt value.

That difference eroded completely Monday when its melt value surpassed its original $32.95 price. The London silver fixing on Monday was $36.60 an ounce, giving each set an intrinsic value of $33.10.

"Recently, the market price of silver has risen substantially," responded US Mint spokesman Michael White to inquiries about the situation.

"As a result, the United States Mint is reviewing the prices of current products containing silver to make sure the market value of the silver contained in them is not now higher than the cost of the products themselves."

New US Mint collectible silver products are not the only ones exploding higher due to their content. The same can be said for older 90% silver coins which have melt values that have not been seen since 1980 when an ounce of silver reached above $50.

It is not known whether precious metals will continue to move higher, but it can be assumed that US Mint coin prices will go higher if the upward trend continues.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_2a.gif)