US Mint Sales: Silver Eagles and Sets Take Off

February 8, 2012 by Rhonda Kay · Leave a Comment

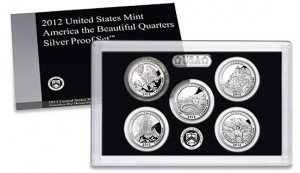

Sales of sets, including the 2012 ATB Quarters Silver Proof Set, improved over the previous week

Silver products spiked in the most recent sales figures from the United States Mint. The 2011-W Uncirculated Silver Eagles soared, and the 2012 America the Beautiful Quarters Silver Proof Set also skyrocketed.

At the top of the chart again was collectible Uncirculated Silver Eagles, but this time their weekly gain was 14,286. Previously they jumped by 4,455. Perhaps the rising price of silver called more attention to the pieces. One ounce of silver on the London Fix averaged $33.63 between Monday and Friday in the most recent round, while it was $32.58 during the last. The coin’s price from the U.S. Mint, however, has remained the same all year at $45.95.

Another impressive sales jump was the 2012 quarters silver proof set. Collectors scooped up 4,422 this time compared to 1,190 in the prior report. The five quarters within it are composed of 90% silver, which means the set has a total of 0.904 ounces of the precious metal. The U.S. Mint is selling the sets for $41.95.

The third most popular item was the 2011 Silver Proof Set. It too experienced higher demand. Its latest advance was 1,180 after having added 947 during the prior week. And finally, close behind the sets were the 2011-P Vicksburg 5 Ounce Silver Uncirculated Coins. Collectors scooped up 1,036 of them.

Bullion Silver Eagles have also been on a roll. After closing out the month of January last Tuesday with 6,107,000 in sales, the first seven days of February started with a bang at 670,000. It will be interesting if February 2012’s total comes close to February 2011’s total, which was 3,240,000. Three full weeks remain, but sales will have to be spectacular in order to reach it.

The following are the latest United States Mint product sales:

U.S. Mint Sales: Silver Coins and Sets for Collectors

|

Previous Sales

|

New Sales

|

Unit Increase

|

% Increase

|

Mintage Limit

|

|

| 2011-W Uncirculated American Silver Eagle | 245,757 | 260,043 | 14,286 | 5.81% | none |

| 9/11 Medals – W | 96,329 | 96,484 | 155 | 0.16% | 2 million |

| 9/11 Medals – P | 62,275 | 62,407 | 132 | 0.21% | |

| 2011 Silver Proof Set | 548,261 | 549,441 | 1,180 | 0.22% | none |

| 2010 Silver Proof Set | 585,414 | 585,414 | – | 0.00% | none |

| 2012 America the Beautiful Quarters Silver Proof Set™ | 70,419 | 74,841 | 4,422 | 6.28% | none |

| 2011 America the Beautiful Quarters Silver Proof Set™ | 137,335 | 137,939 | 604 | 0.44% | none |

| 2011-P Vicksburg 5 Ounce Uncirculated Silver Coins | 11,301 | 12,337 | 1,036 | 9.17% | 35,000 |

| 2011-P Olympic 5 Ounce Uncirculated Silver Coins | 13,120 | 13,598 | 478 | 3.64% | 35,000 |

| 2011-P Glacier 5 Ounce Uncirculated Silver Coins | 15,715 | 16,165 | 450 | 2.86% | 35,000 |

| 2011-P Gettysburg 5 Ounce Uncirculated Silver Coins | 18,544 | 19,109 | 565 | 3.05% | 35,000 |

| 2010-P Mount Hood 5 Ounce Uncirculated Silver Coins | 26,928 | 26,928 | – | 0.00% | 27,000 |

| 2010-P Grand Canyon 5 Ounce Uncirculated Silver Coins | 26,019 | 26,019 | – | 0.00% | 27,000 |

| 2010-P Yosemite 5 Ounce Uncirculated Coin | 27,000 | 27,000 | – | 0.00% | 27,000 |

| 2010-P Yellowstone 5 Ounce Uncirculated Coin | 27,000 | 27,000 | – | 0.00% | 27,000 |

| 2010-P Hot Springs 5 Ounce Uncirculated Coin | 27,000 | 27,000 | – | 0.00% | 27,000 |

| 25th Anniversary Silver Eagle Set | 100,000 | 100,000 | – | 0.00% | 100,000 |

| 2011-W Proof Silver Eagle | 850,000 | 850,000 | – | 0.00% | none |

Monday, February 6, is the "as of date" for all the United States Mint collector coin sales figures shown above.

U.S. Mint Sales: 2011 America the Beautiful Bullion Coins

| Gettysburg | 126,700 |

| Glacier | 126,700 |

| Olympic | 84,600 |

| Vicksburg | 37,300 |

| Chickasaw | 28,100 |

| Total | 403,400 |

Friday, January 27, is the "as of date" for the America the Beautiful bullion coin sales.

U.S. Mint Sales: 2012 American Silver Eagle Bullion Coins

| January* | 6,107,000 |

| February | 670,000 |

| Total | 6,777,000 |

*The sales figures include a portion of the 2011-dated Silver Eagle coins. Tuesday, February 7, is the "as of date" for bullion American Silver Eagles.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/images/quotes_2a.gif)